What keeps you up at night? What makes you nervous? Are everyday financial pressures affecting your levels of stress?

Unsurprisingly, financial worries are the top cause of stress in modern day Australia. While Financial security is generally a high priority for us all. Most struggle with basic personal finances matters, such as budgeting, saving, and planning for the future.

While money doesn't buy happiness, there is some evidence, that tempers this notion. Studies show the link between income and life-satisfaction and well-being are both statistically significant, meaningful and yield a positive relationship.

This article may help you take control finances and your happiness.

Step 1

Three psychological barriers stand in the way for many people when starting the budgeting process:

- Fear what you’ll discover when you examine your finances

- Uncertainty about how to set up a budget

- Doubt whether you can stick to a budget

The good news is, you don’t have to tackle these alone, clever software can really help.

Step 2

Track your income and expenses.

Do not guesstimate your spending and income patterns. Consider adopting tools such as a personal money or wealth portal to help track your spending habits. Some banks will offer online tools that assist in tracking expenses, but few have the power to offer real solutions in taking control off your money.

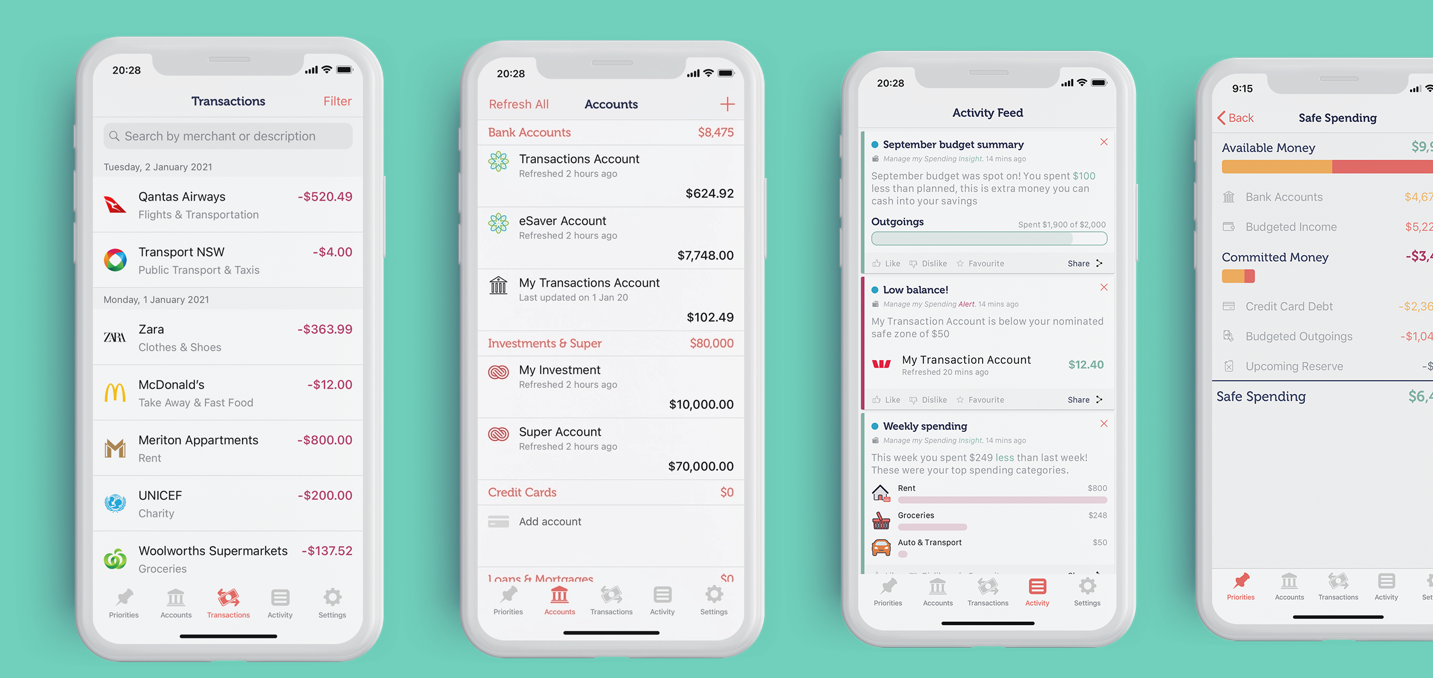

Money portals can link into your bank account to keep track of your income and expenses in one place and auto-categorises them accordingly. The software will add up expenses and subtract them from your income, and will at the most basic level, tell you whether you are operating in the black or the red instantly.

If you don’t have the software to help, track your income and expenses manually in Microsoft Excel or on paper. We suggest doing this for a few months to get a real picture of your financial situation and then follow the process above to add your expenses and subtract from your income.

Step 3

Build your budget

A successful budget enables you to meet your financial obligations and grow your bank balances to achieve life goals. Understand your needs and wants are two separate categories. Make sure you prioritise your needs, pay your mortgage or rent, insurance, loans, and credit card bills to avoid penalties and increased rates.

Also prioritise your emergency fund with regular contributions to protect yourself and anticipate unexpected costs, such as car repairs, medical bills, and emergencies. The rest of your income can then be put toward regular living expenses and wants.

Next, record your actual income and spending, and spot the areas that need attention. If you need to cut expenses, it may be helpful to:

- Consolidate your debt: Debt consolidation can help reduce the stress of multiple debts, different interest rates, multiple account keeping fees and the frequency of repayments.

- Examine all direct debits: it's easy to lose track of direct debits for gym memberships, music streaming etc, look to cancel or pause subscriptions that are not being utilised.

- Pay with cash: There’s something about the tactile quality of cash that makes it hard to part with.

- Adjust your habits: All of us have habits that we fall into that can be revised and adjusted to better fit our future goals.

At this point, some people find it helpful to consult with a financial representative. He or she can look at your numbers and help you put together a balanced budget that addresses all your needs, from meeting monthly obligations and saving for retirement to occasionally splurging.

Step 4

Integrate your budget into everyday life.

Increasingly people are using mobile budgeting tools on their smartphones and tablets. According to studies, individuals who use budget apps frequently, at least once a day, say the tools make them less likely to overspend and will give you financial control from the palm of your hand.

Lastly, set a time each week to review your budget and make sure it continues to fit your goals first, and then your lifestyle. Greater happiness and confidence is just around the corner.

But first cast aside your Fear, Uncertainty and Doubts, and start building a budget.

You don't need to have superpowers to take control. Just discipline and guidance.

Some useful tools:

- Moneybrilliant APP

- MyProsperity APP

- Pocket Book APP

- Moneysmart Gov Website